Cost Of Property Taxes In Texas . Compare that to the national average,. Residents paid an average of $7,689 in 2021—the highest. Web tax rates and levies. In other words, if you own a house in texas valued by a tax. Web the lone star state’s average property tax rate is approximately 1.80%. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web master property taxes in texas: Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary.

from slopeofhope.com

Web the lone star state’s average property tax rate is approximately 1.80%. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. In other words, if you own a house in texas valued by a tax. Web master property taxes in texas: Web tax rates and levies. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Compare that to the national average,. Residents paid an average of $7,689 in 2021—the highest. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed.

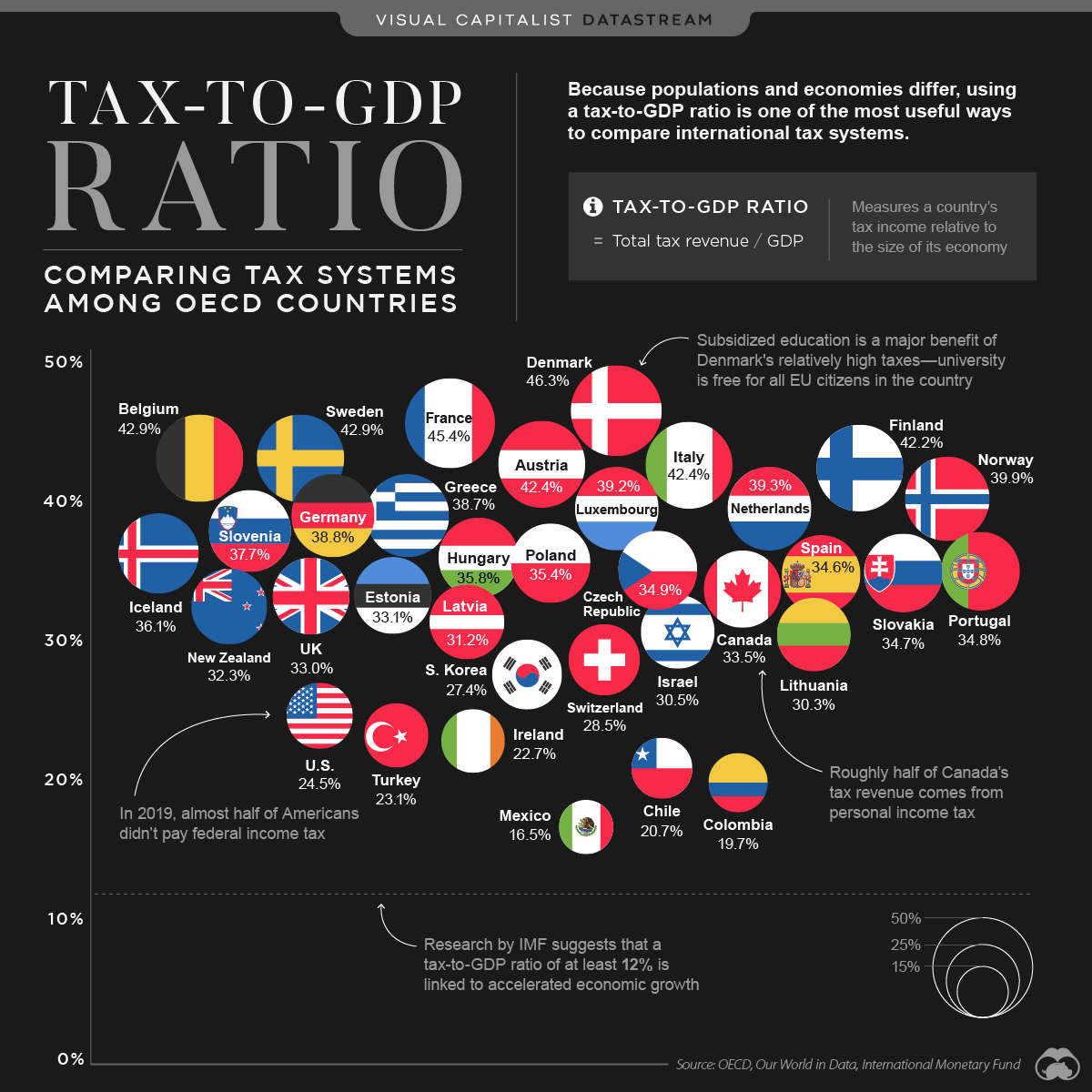

Tax to GDP Slope of Hope with Tim Knight

Cost Of Property Taxes In Texas Web the lone star state’s average property tax rate is approximately 1.80%. Web master property taxes in texas: Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Compare that to the national average,. In other words, if you own a house in texas valued by a tax. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Web tax rates and levies. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Web the lone star state’s average property tax rate is approximately 1.80%. Residents paid an average of $7,689 in 2021—the highest.

From blanker.org

Texas Property Tax Bill Forms Docs 2023 Cost Of Property Taxes In Texas Residents paid an average of $7,689 in 2021—the highest. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. In other words, if you own a house in texas valued. Cost Of Property Taxes In Texas.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Cost Of Property Taxes In Texas Web the lone star state’s average property tax rate is approximately 1.80%. Compare that to the national average,. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Web tax rates and levies. Web the website provides information from your local appraisal district and local taxing units to determine a property tax. Cost Of Property Taxes In Texas.

From www.honestaustin.com

What Are the Tax Rates in Texas? Texapedia Cost Of Property Taxes In Texas Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Compare that to the national average,. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Web the website provides information from your local appraisal district and local. Cost Of Property Taxes In Texas.

From www.youtube.com

How Your Property Tax is Calculated YouTube Cost Of Property Taxes In Texas Web master property taxes in texas: Compare that to the national average,. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Residents paid an average of $7,689 in 2021—the highest. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed.. Cost Of Property Taxes In Texas.

From www.texasrealestatesource.com

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates Cost Of Property Taxes In Texas Residents paid an average of $7,689 in 2021—the highest. Web master property taxes in texas: Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web in texas, with the. Cost Of Property Taxes In Texas.

From www.hometaxsolutions.com

How To Manage Texas Property Taxes Cost Of Property Taxes In Texas Web master property taxes in texas: In other words, if you own a house in texas valued by a tax. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Web the lone star state’s average property tax rate is approximately 1.80%. Compare that to the. Cost Of Property Taxes In Texas.

From unicornmoving.com

Travis County Property Tax Guide 💰 Travis County Assessor, Rate Cost Of Property Taxes In Texas Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real. Cost Of Property Taxes In Texas.

From www.zillow.com

The Highest and Lowest Property Taxes in Texas Cost Of Property Taxes In Texas Web master property taxes in texas: In other words, if you own a house in texas valued by a tax. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Compare that to the national average,. Web the lone star state’s average property tax rate is approximately 1.80%. Web. Cost Of Property Taxes In Texas.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Cost Of Property Taxes In Texas Web master property taxes in texas: Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Web the lone star state’s average property tax rate is approximately 1.80%. Compare that to the national average,. Residents paid an average of $7,689 in 2021—the highest. Web tax rates. Cost Of Property Taxes In Texas.

From www.texasrealestate.com

Property Tax Education Campaign Texas REALTORS® Cost Of Property Taxes In Texas Web master property taxes in texas: Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. In other words, if you own a house in texas valued by a tax. Web tax rates and levies. Residents paid an average of $7,689 in 2021—the highest. Web there,. Cost Of Property Taxes In Texas.

From www.texasmonthly.com

Could Texas Really Eliminate Property Taxes? Texas Monthly Cost Of Property Taxes In Texas Compare that to the national average,. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Web master property taxes in texas: Residents paid an average of $7,689 in 2021—the highest. Web tax rates and levies. Web the lone star state’s average property tax rate is approximately 1.80%. Tax. Cost Of Property Taxes In Texas.

From canvas-tools.blogspot.com

Taxes In Austin Texas canvastools Cost Of Property Taxes In Texas Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Compare that to the national average,. Web tax rates and levies. In other words, if you own a house in texas valued by a tax. Web the lone star state’s average property tax rate is approximately 1.80%. Tax code. Cost Of Property Taxes In Texas.

From texasscorecard.com

Commentary How Property Taxes Work Texas Scorecard Cost Of Property Taxes In Texas Compare that to the national average,. Web tax rates and levies. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. In other words, if you own a. Cost Of Property Taxes In Texas.

From cecblydv.blob.core.windows.net

Texas County Oklahoma Property Tax Search at Felix Hanson blog Cost Of Property Taxes In Texas Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Web master property taxes in texas: In other words, if you own a house in texas valued by a tax. Tax code section 5.091 requires the comptroller's office to prepare a list that includes the total tax rate imposed.. Cost Of Property Taxes In Texas.

From www.hayshomesales.com

Understanding Property Taxes in Texas Cost Of Property Taxes In Texas Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Web tax rates and levies. Compare that to the national average,. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real property form the primary. Web the lone star state’s average property. Cost Of Property Taxes In Texas.

From kecilibger.blogspot.com

what is the property tax rate in dallas texas Consecration Vlog Photo Cost Of Property Taxes In Texas Web the lone star state’s average property tax rate is approximately 1.80%. Web there, a typical home cost around $706,000, but the effective tax rate was 1.09%, the figures showed. Compare that to the national average,. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Tax code section. Cost Of Property Taxes In Texas.

From www.texaspolicy.com

Anyone believe local property taxes in Texas should rise faster? Cost Of Property Taxes In Texas In other words, if you own a house in texas valued by a tax. Residents paid an average of $7,689 in 2021—the highest. Web tax rates and levies. Web the lone star state’s average property tax rate is approximately 1.80%. Web in texas, with the absence of a state income tax and relatively low sales taxes, fees levied on real. Cost Of Property Taxes In Texas.

From austinrealestatesecrets.blogspot.com

Lowering Your Texas Property Taxes Cost Of Property Taxes In Texas Compare that to the national average,. Web the website provides information from your local appraisal district and local taxing units to determine a property tax estimate for. Residents paid an average of $7,689 in 2021—the highest. Web the lone star state’s average property tax rate is approximately 1.80%. Tax code section 5.091 requires the comptroller's office to prepare a list. Cost Of Property Taxes In Texas.